25+ Roth 401k calculator 2021

For 2022 the maximum annual IRA contribution of 6000 is an unchanged from 2021. The threshold is anything above an adjusted gross income of 144000 up from 140000 in 2021 for those filing as single or head-of-household.

The Benefits Of A Backdoor Roth Ira Financial Samurai

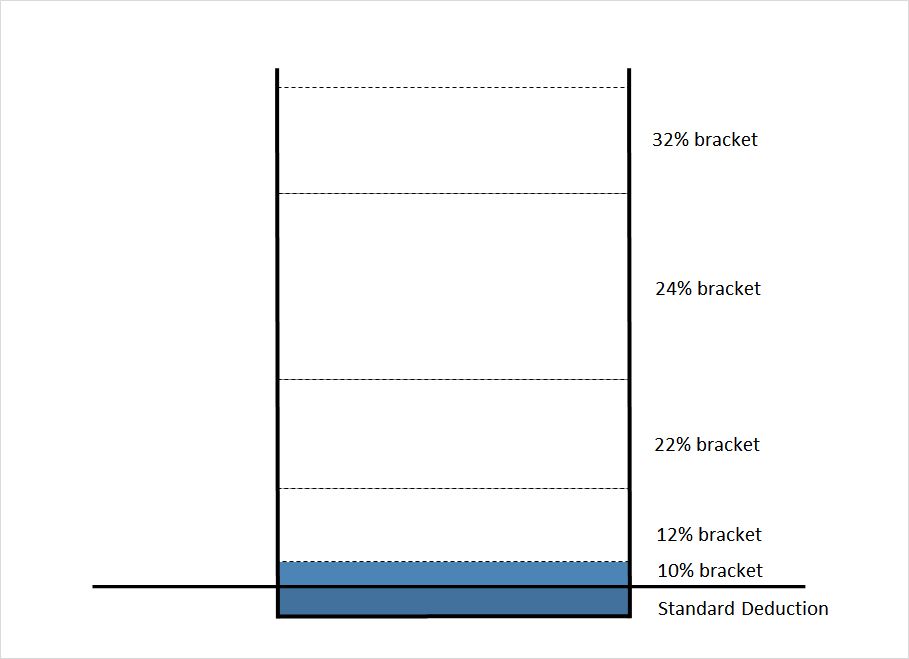

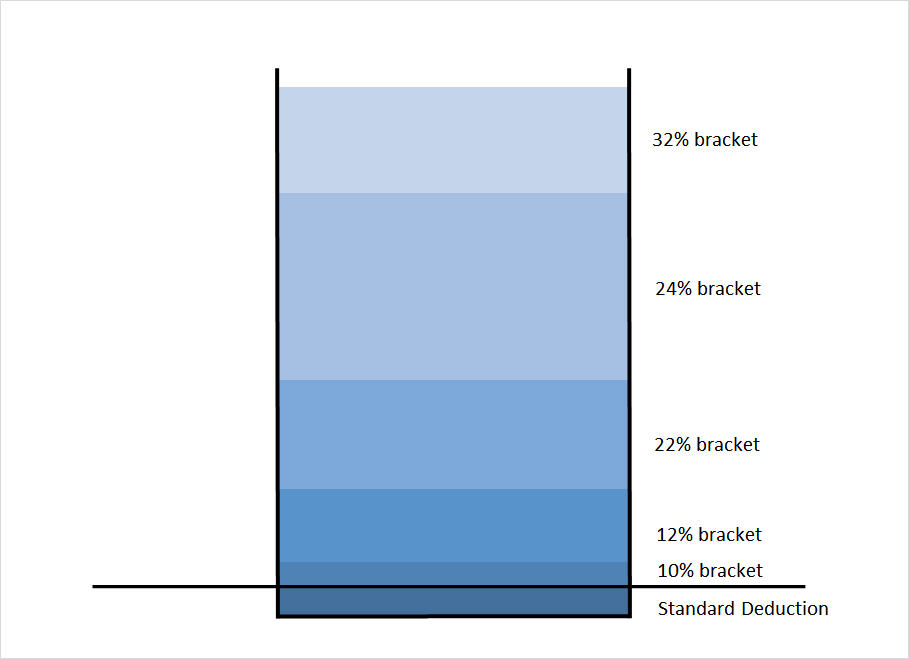

Contributions made to a Roth 401 k or IRA are made on an after-tax basis which means that taxes are paid on the amount contributed in the current year.

. Contributions to a Traditional 401 k or individual retirement accounts are made on a pre-tax basis resulting in a lower tax bill and higher take-home pay. Subtract from the amount in 1. Discover Bank Member FDIC.

Free inflation-adjusted Roth IRA calculator to estimate growth tax savings total return and balance at retirement with the option to contribute regularly. Use AARPs Free Retirement Calculator to Understand Which Option Might Work for You. Roth 401 k contributions allow you to contribute to your 401 k account on an after-tax basis and pay no taxes on qualifying distributions when the money is withdrawn.

Lets check out some examples using our retirement calculator to see how this works in reality. Rolling Over a Retirement Plan or Transferring an Existing IRA. Employee elective deferral contributions can be made to only one 401k account.

Traditional vs Roth Calculator. As of January 2006 there is a new type of 401 k contribution. Divide the result in 2 by 15000 10000 if filing a joint return qualifying widow er or married filing.

It is important to note that this is the maximum total contributed to all of your IRA accounts. Whether you participate in a 401 k 403 b or 457 b program the information in this tool includes education to assist you in determining which option may be best for you based on your personal financial situation. We use the current total.

Wed suggest using that as your primary retirement account. For some investors this could prove to. The Roth 401 k allows contributions to a 401 k account on an after-tax basis -- with no taxes on qualifying distributions when the money is withdrawn.

If you have a 401k or other retirement plan at work. If youve saved nothing and your sixties are just around the corner not so much. Get a Diversified Portfolio for your Retirement Goalsin One Simple Investment.

This limit applies across all IRAs. Your employer needs to offer a 401k plan. NerdWallets 401 k retirement calculator estimates what your 401 k balance will be at.

This calculator assumes that you make your contribution at the beginning of each year. Ad If you have a 500000 portfolio get this must-read guide from Fisher Investments. There is an upper limit to the combined amount you and your employer can contribute to defined 401 ks.

A 401 k account is an easy and effective way to save and earn tax deferred dollars for retirement. For those who are married and filing. 125000 for all other individuals.

We account for the fact that those age 50 or over can make catch-up contributions. The amount you will contribute to your Roth IRA each year. You can contribute up to 20500 in 2022 with an additional 6500 as a catch-up.

Depending on your. Ad Open a Roth or Traditional IRA CD Today. Impact on retirement fund balances Beneficiary required minimum distribution.

This tool compares the hypothetical results of investing in a Traditional pre-tax and a Roth after-tax retirement plan. We use the current maximum contributions 18000 in 2015 and 53000 including company contribution and assume these numbers will grow with inflation over time. 401k and Roth contribution calculator.

For those 50 and older the limit is 67500 in 2022 up from 64500 in 2021. A 401 k can be an effective retirement tool. Lets begin with a best case scenario.

Ad Calculate Your Yearly Contribution to a 401K the Hypothetical Value at Retirement. Youre 25 and youve only been working a few years before you decide to get smart about your retirement. Traditional 401 k and your Paycheck.

Discover Makes it Simple. For those age 49 and under the limit is 61000 in 2022 up from 58000 in 2021. You cant contribute more than your earned income in any year.

As a sole-proprietor or owner of an LLC taxed as such we are able to contribute to a solo 401k retirement account as both the employer and employee. Total contributions cannot exceed net earnings or the 415c limit 56k in 2019. The Roth individual retirement account Roth IRA has a contribution limit which is 6000 in 2022or 7000 if you are age 50 or older.

198000 if filing a joint return or qualifying widow er -0- if married filing a separate return and you lived with your spouse at any time during the year or. Ad A One-Stop Option That Fits Your Retirement Timeline.

How Much Money Should You Invest In A Roth Ira Per Month In Your 20s Quora

Roth Ira Vs Traditional Ira Roth Ira Investing Traditional Ira Personal Finance Quotes

The Case Against Roth 401 K Still True After All These Years

Contribute To My 401k Or Invest In An After Tax Brokerage Account

The Benefits Of A Backdoor Roth Ira Financial Samurai

The Case Against Roth 401 K Still True After All These Years

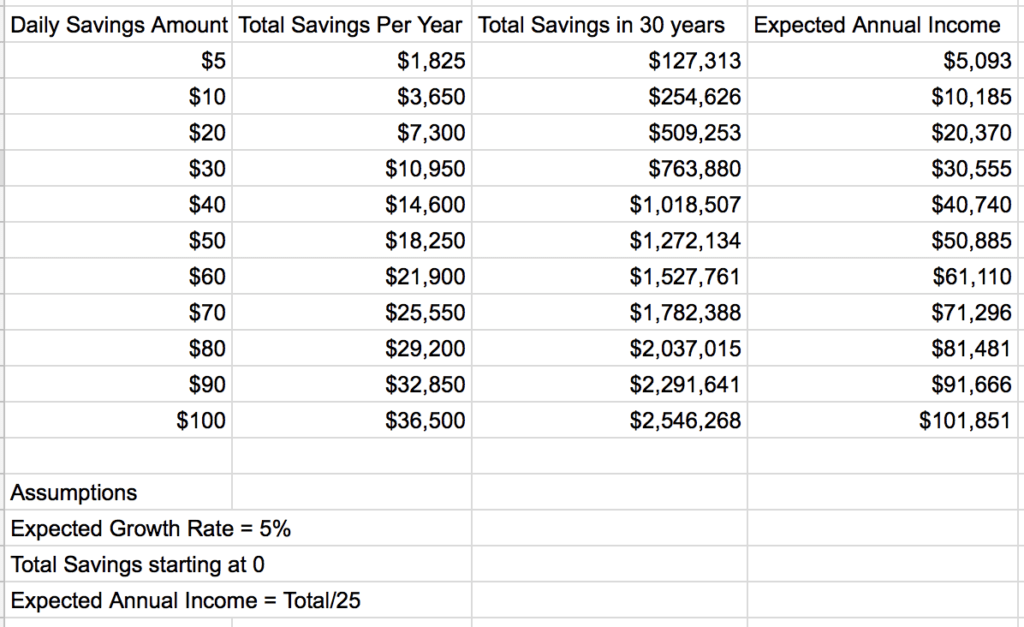

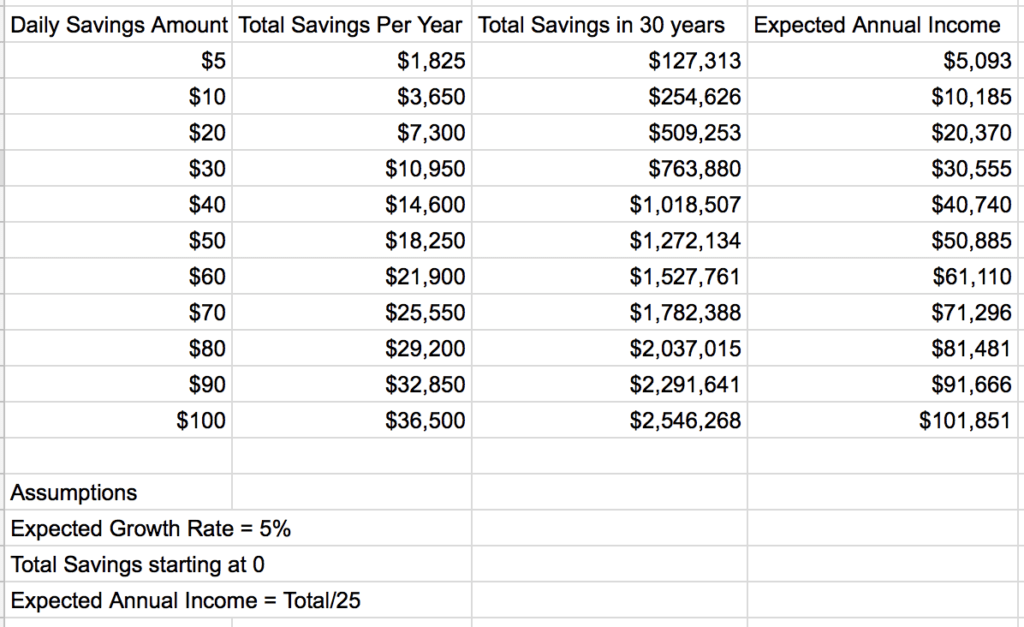

Early Retirement Strategy Retire Early With 40 A Day My Personal Finance Blog

New Jersey Secure Choice Faqs Fisher401k

401k To Roth Ira Conversion Rules Taxes Limits

The Benefits Of A Backdoor Roth Ira Financial Samurai

The Case Against Roth 401 K Still True After All These Years

How Much Should A 42 Year Old Invest In Roth Ira Monthly For How Long And Can I Open An Account For Kids 7 5 And 1 How Much And How Long Is There

Sum Of Year Digits Method Of Depreciation How To Calculate With Example

:max_bytes(150000):strip_icc()/dotdash_Final_Options_Basics_How_to_Pick_the_Right_Strike_Price_Feb_2020-01-acdb55c99d224a48afe733fe552c796e.jpg)

Options Basics How To Pick The Right Strike Price

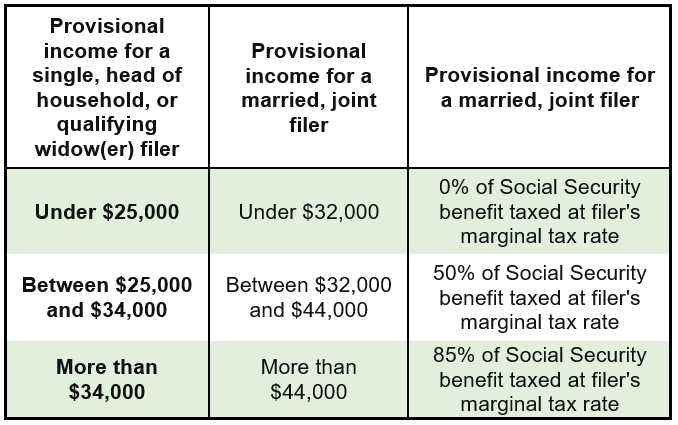

Social Security And Taxes Could There Be A Tax Torpedo In Your Future Apprise Wealth Management

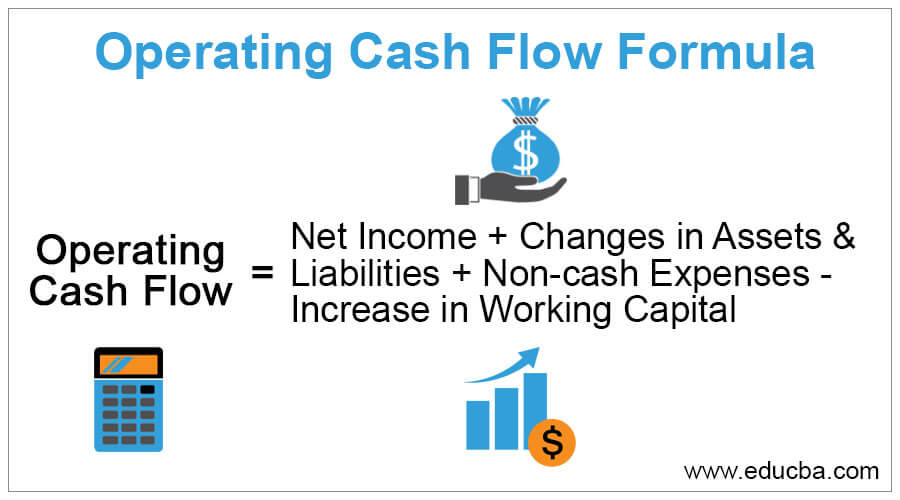

Operating Cash Flow Formula Examples With Excel Template Calculator

Contribute To My 401k Or Invest In An After Tax Brokerage Account